Melbourne,

Australia - The Motorcycle Dealing industry was cruising until the global

financial crisis halted revenue growth. Demand for motorcycles suffered as

households became pessimistic about the future and stopped spending money on

unessential items.

Initially, demand for scooters also dropped due

to a fall in petrol prices, which hindered the commuter market and affected the

shift from cars to cheaper modes of transportation. However, this trend has

since reversed.

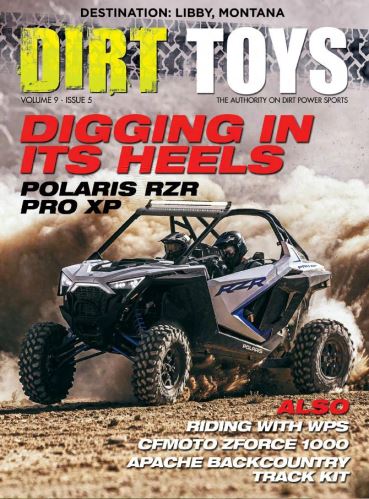

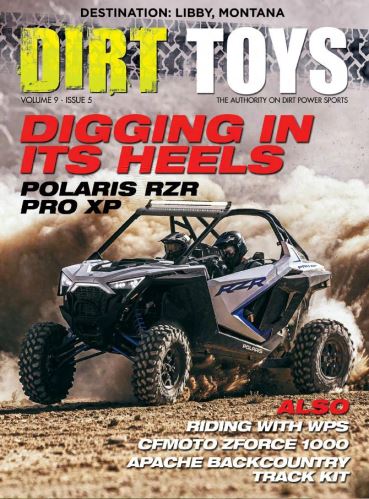

All-terrain vehicles (ATVs) have been resilient

as farmers' incomes have risen due to easing drought conditions. Demand for

farm equipment (including ATVs) has also been supported by a business tax break

from the government. Sales of on-road and off-road bikes have been dismal.

According to IBISWorld industry analyst Aries Nuguid,

"Industry revenue is estimated to decline by an annualised 1.9 percent over the

five years through 2011-12 to reach $3.57 billion." However, the industry is

expected to make a pronounced revenue recovery of 2.2 percent in 2011-12.

Sales are expected to

rev up over the next five years, backed by higher disposable incomes and fuel

prices. Motorists will shift to more fuel-efficient commuting options such as

motorcycles due to high fuel prices. "However, motorcycle dealers will face

tougher competition from the Car Retailing industry, as it will also provide

fuel-efficient and environmentally friendly vehicles to address high fuel

prices," Nuguid adds. Industry revenue is forecast to rise over the next five

years through 2016-17.

The Motorcycle Dealing industry

is characterised by a low level of market share concentration. There are a

large number of small dealerships in the industry, and these small dealerships

make up a high proportion of industry revenue. The industry is highly

fragmented, with most dealers only having one establishment. IBISWorld does not

expect concentration to change significantly over the next five years, as

industry revenue is expected to grow over the period, keeping the entry and

exit of working proprietors and smaller franchise dealers

relatively constant.

For more information, visit IBISWorld's Motorcycle Dealing report

in Australia

industry page.