By St. Cloud Times

www.sctimes.com

Arctic Cat sales took off like a rocket in the first quarter

of the 2013 fiscal year, according to data the company released last month.

That means engine manufacturing has been at a fever pace at

Arctic Cat's engine manufacturing facility, located since 2007 in St. Cloud. And, based on

other information from the quarterly report, it will get busier in the future.

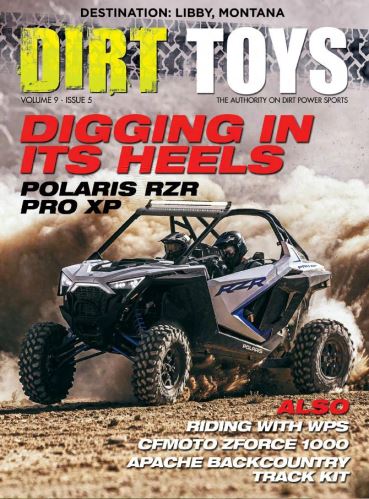

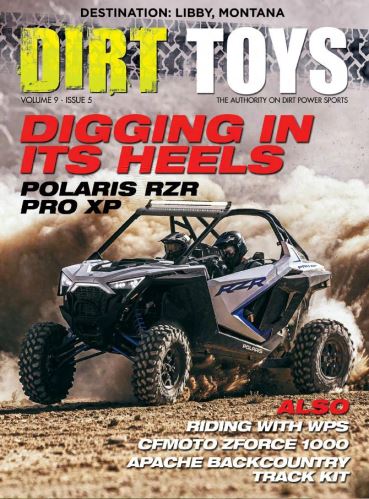

Net sales jumped 49 percent to $111.3 million, primarily

because of the popularity of side-by-side, or recreational off-road vehicles

(ROVs)-engines for which are made in Central Minnesota.

Net sales from the same quarter in 2012 were $74.9 million.

Net earnings were $2 million or 14 cents per diluted share

for the fiscal quarter ended June 30. Arctic Cat had a prior year net loss of

$2.3 million, a drop of 13 cents per diluted share.

"Sales rose across all product lines in the first quarter,

led by strong contributions from our new Wildcat pure sport and Prowler

side-by-side vehicles, and core ATVs (all-terrain vehicles)," Arctic Cat

President and Chief Executive Officer Claude Jordan said in a statement. "We

continued to leverage higher sales volumes and a lower cost structure to

deliver improved profitability."

Arctic Cat also is known for its snowmobiles. Engines for

those machines have been made in Japan

by Suzuki Motor Corp.; however, late last year Arctic

Cat bought Suzuki's 6.1 million Arctic Cat shares for more than $79 million in

cash.

While Suzuki will provide replacement parts until 2020,

Arctic Cat will move snowmobile engine manufacturing to St. Cloud by 2014.

Arctic Cat, which has no long-term debt, owns the St. Cloud facility, which

covers more than 60,000 square feet.

Snowmobiles made up about 43 percent of Arctic Cat's net

sales in 2012. ATVs accounted for about 39 percent of sales, with parts,

garments and accessories comprising the rest.

According to the report, a $100 investment in Arctic Cat

stock in 2007 was worth more than $230 when fiscal 2012 ended on March 31.

A $100 investment in the S&P 500 during the same time

frame was worth about $110. And a $100 investment in the Hemscott-Recreational

Vehicles Index was worth about $114.

"We are bullish about our future," Jordan said.

"Our goal for fiscal 2013 is to deliver the highest net earnings in Arctic

Cat's 50-year history."

For more information, visit www.arcticcat.com.