Montreal - BRP is braced for a softening in sales in Russia in the coming year because of "political and economic instability" in the company's third-largest market, the recreational vehicle manufacturer said recently.

The maker of snowmobiles, personal watercraft and all-terrain vehicles said the Russian market, which has grown by 20 per cent annually over the last decade, has faced challenges in the last six months because of weaker demand due to poor snow conditions and a sharp decline in the value of the ruble.

The currency hit has forced dealers to increase prices, putting a damper on sales, especially over the final three months of BRP's fiscal year.

The Quebec-based company is now forecasting a 20 per cent reduction in sales volume after discussing the potential impact of unrest in Ukraine with its local distributors. The change could reduce profits by 10 cents per share.

"We remain mindful of the challenges we could face if consumers in this region were to postpone their buying decision. As such we have been prudent in our forecast and will continue to closely monitor the situation," CEO Jose Boisjoli said during a conference call with analysts after reporting fourth-quarter results that missed expectations.

Russia accounts for the bulk of BRP's $235 million worth of sales in eastern Europe.

On the Toronto Stock Exchange, BRP shares (TSX:DOO) were down $3.42 or almost 11 per cent at $28.44 afternoon trading last Friday.

BRP said posted a net loss of $6.3 million on $902.9 million of revenues in the three months ended Jan. 31. That compared with $35.8 million of net income on $791.5 million of revenue in the prior year.

Excluding one-time items, adjusted profit was $48.3 million or 41 cents per share, compared with $36.5 million or 35 cents per diluted share a year earlier. BRP had been expected to earn 45 cents per share on $851.8 million of revenues, according to analysts polled by Thomson Reuters.

Meanwhile, the potential hit in one of its key markets has been factored into BRP's guidance for the coming fiscal year. It expects adjusted net income will increase by between 10 and 17 per cent from last year to reach $1.55 to $1.65 per share, while revenues will increase by nine to 13 per cent.

Benoit Poirier of Desjardins Capital Markets said BRP's guidance for next year remains "solid," presenting a buying opportunity because of the weaker than expected results for the fourth quarter.

Sales of seasonal products, year-round products, propulsion systems and parts all grew during the fourth quarter. The strengthening of the U.S. dollar and the euro against the Canadian dollar helped add $53 million for the quarter.

However, the company expects first-quarter results will be negatively impacted by delays in summer product shipments caused by a prolonged winter and the slow ramp-up of production in Mexico. It forecasts revenue to decrease between five and 10 per cent and normalized EBITDA to fall about 50 per cent.

For the full year, BRP earned $168.3 million or $1.49 in adjusted earnings last year, up 15 per cent from the prior year as revenues surpassed the $3 billion mark for the first time, rising 10.3 per cent to $3.2 billion.

Including one-time items, it earned $59.7 million, about half the $119.2 million earned in 2012.

The company said the longer North American winter translated into a very strong snowmobile season, which is highly influenced by snowfall. It started the season with the lowest inventories since 2001 and was unable to increase production because of lead times. Shortages at some dealers caused a loss of market share, but that bodes well for next year, Boisjoli told analysts.

The prolonged winter has also delayed interest in summer personal watercraft with attendance at boat shows being down, he added.

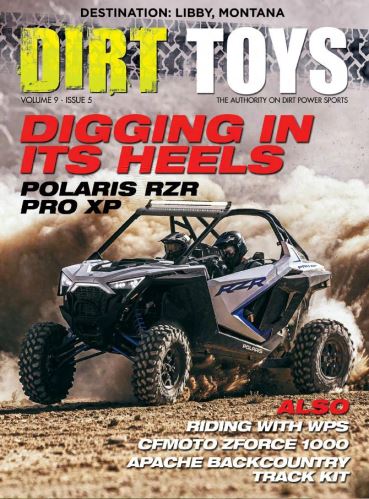

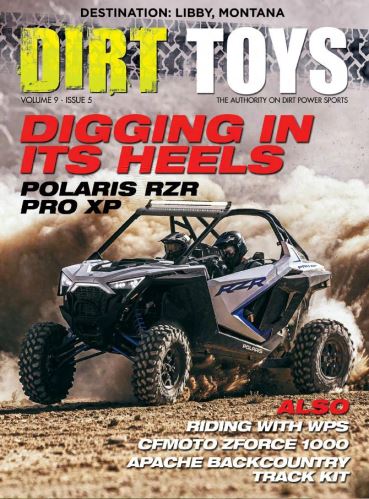

Sales of off-road vehicles has also been weak in the last two months because of the long, cold winter as about 70 per cent of such vehicles are sold in the snowbelt market.

Boisjoli said its new manufacturing operations are "under control" after sustaining challenges in ramping up production since October.

"The ramp-up, the way we had planned it originally, was inefficient," he said.

The company has decided to "relax" the ramp-up and some products that were supposed to be assembled in the first quarter, will be assembled in the second quarter in Valcourt, Que.

Follow @RossMarowits on Twitter.